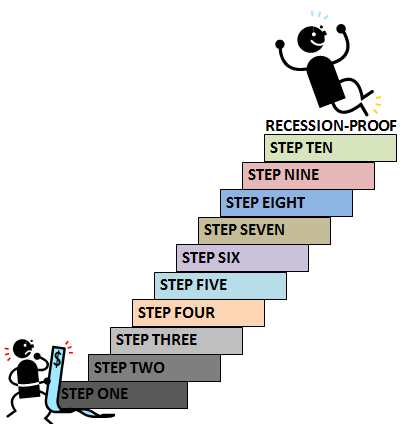

Recession Proof – Step 5

I am so excited we’re at step five in this 10-step plan for creating a recession-proof marriage and household. For those joining us today for the first time in this blog series on shielding your family and marriage from this current economy, I’d like to encourage you to go back and review the first four steps. Here’s a quick recap:

STEP ONE: Stop comparing yourself to others and learn to be content (or even better, happy) with exactly what you have in this moment. As Rick Warren said and I love repeating, “If the grass is greener on the other side, that’s because your neighbor has a higher water bill!”

STEP TWO: Team up with your partner in life, your spouse, and pray for wisdom. This is different from the prayers you may have prayed until now. You’re not asking God to magically make your debt disappear or magically increase your income. You’re asking for the wisdom to allow you to do it yourself. No one knows your financial future better than Him so that is the life source you want to stay connected to throughout this process and beyond.

STEP THREE: Strip down your image. There is no doubt that a part of the wisdom you will be given will require great sacrifice and that means you will need to be okay with whatever anyone else may think of you. Don’t allow your fear of how others might respond to keep you straddled with the burden of debt. It’s just not worth it.

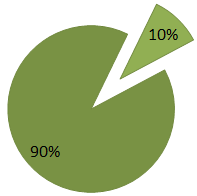

STEP FOUR: The 10/90 Rule. Many financial experts will tell you about the 80/10/10 rule and it is what Keith and I follow today. But I learned early in my adult life that the 80/10/10 principle was a goal but for those desiring financial freedom, I believe the 10/90 rule is a requirement. It is what I used 12 years ago to turn my financial situation around and I’ve never met a person for whom it did not work.

and I follow today. But I learned early in my adult life that the 80/10/10 principle was a goal but for those desiring financial freedom, I believe the 10/90 rule is a requirement. It is what I used 12 years ago to turn my financial situation around and I’ve never met a person for whom it did not work.

STEP FIVE: (we’re discussing today): Allowance isn’t just for kids.

Keith and I have been giving ourselves an allowance for at least the past six years. The reason we began doing this is we realized more often than not a monthly budget is just a number on a piece of paper. It is a goal, similar to a New Year’s resolution. But the number of people who manage to stick to their budget is about the same as the number of people who stick to their annual resolutions.

I don’t remember exactly where or from whom we learned about giving ourselves an allowance but continuing to do it over all these years has helped keep us stay on track financially. Here’s how it works. All of our income goes into a household account and each month we both get an “allowance” from our joint checking account. That money is the maximum we commit to spend that month on our personal needs – and we stick to it.

We decided in advance who would pay for what out of their allowance (for instance, groceries might come out of your allowance while date nights may come out of your hubby’s). We determined our allowances based on needs and a few wants. And by needs, I mean actual necessities.

We decided in advance who would pay for what out of their allowance (for instance, groceries might come out of your allowance while date nights may come out of your hubby’s). We determined our allowances based on needs and a few wants. And by needs, I mean actual necessities.

In determining my actual needs, I tracked my expenses for a month or two by obtaining receipts for every single purchase I made and making every purchase in cash. Even something as small as a pack of gum for $.89. If I spent money, I tracked it. At the end of the month, I was able to ascertain what expenses were actual “needs” and which were “wants.”

The process of determining needs vs. wants can become quite complicated if we allow it to be. But really it should be simple. For instance, cable is a “want” while internet, depending on what you do for a living, may be a “need.” Coffee may be important to you to give a “pick me up” if that’s what your body is accustomed to in the morning. But a $4 cup of coffee from Starbucks definitely falls under the “want” category.

Ladies, I know it can really get tricky for us but let me help you see the difference between needs and wants when it comes to our personal beautification. Getting our hair done, manicures and pedicures at an actual salon are a “want.” Looking presentable for work and overall in life is important but there are many ways to get there. I can count on one hand the number of manicures and pedicures I’ve actually gotten done at a salon in the past year and my hair dresser, who at one point saw me every week, now sees me bi-monthly for a trim.

get there. I can count on one hand the number of manicures and pedicures I’ve actually gotten done at a salon in the past year and my hair dresser, who at one point saw me every week, now sees me bi-monthly for a trim.

Gym memberships, as long as there is grass and concrete outside to run or walk and videos you can buy or rent to excercise from home, are a “want.” I went from spending $150/mo for an upscale gym membership to $0/mo to practice yoga with a video. And you know what? I’m now in the best shape of my 35-year old life.

Buying a new shirt because the one you have is “so last season” is definitely a want. Purchasing another pair of shoes when you already have 50 pairs, no matter how “necessary” they are, is also a want. Even purchases in the grocery store need to be divided between needs and wants. Now, I’m not saying life should be boring and you shouldn’t have a lot of your “wants,” it just depends on where you are financially.

After Keith and I paid off all our debt a couple years ago (sans mortgages), we returned to much more liberal spending habits. But now that we’re actively engaged in paying off our mortgages we’ve once again reined in our spending quite a bit and returned to limiting ourselves mainly to our “needs” while sprinkling in a few “wants” here and there.

Once you’ve determined not to participate in this recession and begin dumping any financial debt you might be carrying, embracing radical ideas may be necessary. When Keith and I started making drastic changes to curb our spending habits and told my brother-in-law about it, he sent a text that read, “You’ve got some NURV!” That acronym, borrowed from a movie, is exactly what I’ve been writing about in this recession-proof blog series: Never Underestimate Radical Vision.

Even daring to talk about becoming recession-proof three years into the worse recession of our lifetime, knowing most economists expect it to get worse before it gets better, takes a lot of NURV. And creating a financial plan that keeps you on track should be just as radical. And a weekly, bi-weekly or monthly allowance may just do the trick.

Even daring to talk about becoming recession-proof three years into the worse recession of our lifetime, knowing most economists expect it to get worse before it gets better, takes a lot of NURV. And creating a financial plan that keeps you on track should be just as radical. And a weekly, bi-weekly or monthly allowance may just do the trick.

Everyone’s different but I’ll share with you my exact plan. Each month, I deposit the same allowance amount into a personal checking account. And Keith does the same. I then withdraw 1/5th of the total amount in cash. That is what I give myself for the upcoming week.

What’s great about an allowance being in a separate account is there is no extra money to spend. Once it’s gone it’s gone so it forces me to spend wisely throughout each week and over the course of the month. The reason I withdraw 1/5th each week instead of 1/4th is because I want to keep a little extra in the account just in case I come across a “want” I really, really want.

Listen, I realize this may be a little too “radical” for some. Many like having more flexibility. And I recognize one size does not fit all. But what I can tell you is it’s worth a try. Track your receipts this month – even for bubblegum – and tally them up at the end of the month. Then separate the purchase receipts into two piles. The first pile should be of items you purchased that were needed. It is the total from this pile that should be used as a basis for determining your monthly allowance.

Test this for a few months and see how much you save. Really, what do you have to lose? If you don’t like it, go back to what you were doing before. My desire is to see you debt-free and not participating in this recession. And this is Step Five.

Next, we’re going to help you start freeing yourself from some of the bills hanging over your head by redefining the American Dream. Understanding the difference between what the dream was meant to be and what it has become just might be the puzzle piece you were missing to begin pulling yourself out of debt. Ready? Let’s go.

redefining the American Dream. Understanding the difference between what the dream was meant to be and what it has become just might be the puzzle piece you were missing to begin pulling yourself out of debt. Ready? Let’s go.

Until Monday…make it a great weekend!

Comments: With more than 15,000 Happy Wives Club members already actively engaged on our Facebook page, what better place to share your thoughts? Join me there and let’s continue the conversation: Happy Wives Club Facebook

Fawn Weaver