Recession Proof – Step 1

Yesterday, after writing the daily blog saying I’d be talking about finances for the next week, I felt  massive butterflies in my stomach. I don’t remember ever feeling that way after writing a blog post. But I know why. Finances is a tough subject. It is the topic dividing homes all over the country and people have extremely different views on debt, spending, giving, etc.

massive butterflies in my stomach. I don’t remember ever feeling that way after writing a blog post. But I know why. Finances is a tough subject. It is the topic dividing homes all over the country and people have extremely different views on debt, spending, giving, etc.

Before I continue writing, I want to invite anyone who did not view the blog yesterday to please click here. The reason is there was a disclosure regarding this topic that’s important for you to read prior to determining if you still desire to hear my thoughts on this topic.

Finances is one of my absolute favorite topics for a few reasons. The first is in the Bible, Jesus spoke more about finances and stewardship than any other topic. I don’t know what that says to you but that tells me it’s pretty important. The second reason I love talking about finances so much is it is one of the areas in our lives where I believe we can have a direct and immediate impact.

Since this is such a hot topic and weighty subject for many, I’m going to break this blog post up into many different parts. Don’t know how many parts we’ll end up with when it’s all said and done but this is Part I. My hope and desire is you will glean some wisdom from each of the individual postings and by the time you get to the last posting, you will already be on the path to creating a Recession Proof marriage and household.

So, let’s get to it. When talking about finances there are a few basic views I hold that you should know about as you’ll read about each of them at some point throughout the next few days:

about as you’ll read about each of them at some point throughout the next few days:

- Blaming causes procrastination. It is difficult to work on a problem we don’t acknowledge we have the tools and ability to fix. When we spend time pointing fingers at anyone but ourselves we prolong the inevitable: no progress. We all play a part in our personal financial situation and we all hold the keys to change it for the better or for the worst.

- If you spend more than you earn…you will perpetually be in debt. Time Magazine did a study that showed for every $1,000 the average American makes we spend $1,300. Now, I don’t know about you but if we spend almost 30% more than we make it would make sense that most people find themselves constantly trying to climb out of debt.

- Credit cards should be used sparingly and paid off at the end of every month so money that could be used to pay for essentials is not being wasted on interest (for those deep in credit card debt, don’t worry, this is still possible to get done and we’ll talk about how).

- The American Dream does not need to include owning a home. We live in an amazing country but perpetually staying in debt has become a huge part of the equation because we’ve somehow made owning a home such an important part. Here’s a fact to consider: most people who say they “own their home” are actually just occupying a home (with a huge amount of debt attached). Very few people actually “own” their home. Until a home is free and clear…it is not owned. If you don’t believe me, ask the millions of “home owners” who have been foreclosed on in the past few years.

- Multiple wars, poor government fiscal management and corporate greed by banks and Wall Street may be a large part of the problem that caused the country’s recession, BUT that doesn’t determine our personal financial destiny or resolve.

Alrighty then, now that we’ve gotten that out of the way we can get real and have a serious discussion. I am going to share with you many personal lessons I’ve learned through gaining and losing over the years and gaining again. But first, let’s be really honest with each other.

How long have you been in debt? Did it precede the start of this 2008 recession? And as long as we’re being honest, how long were you in debt before you actually realized you were in debt? For my part, I’ve remained in some form of debt all of my life and didn’t recognize it as such until a few years ago. Even when I only had the ability to make minimum payments on my credit cards, I didn’t think I was in debt.

How long have you been in debt? Did it precede the start of this 2008 recession? And as long as we’re being honest, how long were you in debt before you actually realized you were in debt? For my part, I’ve remained in some form of debt all of my life and didn’t recognize it as such until a few years ago. Even when I only had the ability to make minimum payments on my credit cards, I didn’t think I was in debt.

Even now, after becoming “debt free” a year ago (at least as most people define it), we still have mortgages that we’re laser beam focused on getting paid off. We don’t consider ourselves to be debt-free because of our mortgages but we have made our household “recession-proof” and I’ll share with you the difference over the next few days but for the purpose of this blog posting, allow me to at least share with you a few thoughts:

- Creating a “recession-proof” household — even if you’ve found yourself struggling for the past three years since the economy began sliding downhill (or even before) — is still possible and you can begin today.

- If you are reading this blog you are likely married. And if you’re married, becoming debt-free and recession-proofing your household becomes a “team” effort rather than an individual endeavor which allows you to accomplish twice as much in a shorter period of time. And if you have able-bodied teenagers or adult children, that possible effort just multiplied tremendously.

- Becoming recession-proof requires the right mindset, a lot of effort and complete dedication. The mindset portion of this is the most important for a number of reasons and will be a large part of our discussion over the next few days.

I heard Rick Warren say the other day, “If the grass is greener on the other side, that’s because your neighbor has a higher water bill!” I loved that because it’s so true. The first thing you must do to recession-proof your marriage and household is this: Do not compare yourself, what you have or how you live to anyone else.

neighbor has a higher water bill!” I loved that because it’s so true. The first thing you must do to recession-proof your marriage and household is this: Do not compare yourself, what you have or how you live to anyone else.

Be content with what you have at this moment. You have more years to live and more material things to gain (if you choose) but in this moment, on this day, at this exact time, what you have is what you have and learning to be content is the first step toward recession-proofing your life.

Hands down, this will likely be the most difficult step you’ll take throughout this process because you will need to stop comparing. The reason this is so tough is because for most of us, comparing ourselves to other people comes naturally. Many of us don’t even realize we’re doing it. Let me ask you a question. If you and your spouse were the only two people living on earth, would you care about the house you’re living in and for that matter would you even notice the difference between living in a house that’s “owned” versus renting a home or apartment?

This may seem like a silly question but pondering it will help you make this important first step. If you and your spouse were the only two people alive on this earth would you be ecstatic to watch television shows on whatever TV you owned or would you “need” to have a 60” flat screen hanging on your wall? Would you “need” a newer car or would the one you have work just fine because it continues to get you from point A to point B and back home again?

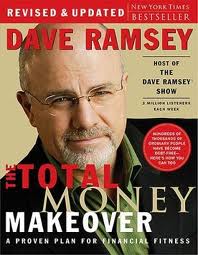

I remember when we first read Total Money Makeover by Dave Ramsey, we began telling everyone about it. Our brother-in-law, Tray, read the book and began working on becoming debt free immediately. One of the first people he talked to after reading it was talking about buying a new car and wanted to know his opinion on which car to get. He told her, “Before you consider buying a new car, I only have one request. Read Total Money Makeover first.”

I remember when we first read Total Money Makeover by Dave Ramsey, we began telling everyone about it. Our brother-in-law, Tray, read the book and began working on becoming debt free immediately. One of the first people he talked to after reading it was talking about buying a new car and wanted to know his opinion on which car to get. He told her, “Before you consider buying a new car, I only have one request. Read Total Money Makeover first.”

Needless to say, she read the book and then told Tray, “I’m going to keep driving this car until the wheels fall off!” Several years later she continues to drive her little white Toyota with dents and dings everywhere but she has freed herself of the “need” to buy a new car. She realized the one she had successfully got her from point A to point B every day and if she wasn’t comparing her car to anyone else’s, it was more than enough.

Whoa…this posting is getting far too long so now is a good time to wrap up for the day and invite you to join me again tomorrow. Freedom of mind and the weight of the world lifted off your shoulders is possible. And it doesn’t have to take as long as you might think.

You have a full twenty-four hours until we meet again so take the time to ponder the quote I mentioned above from Rick Warren:

“If the grass is greener on the other side, that’s because your neighbor has a higher water bill!”

Until tomorrow…make it a great day!

Comments: With more than 15,000 Happy Wives Club members already actively engaged on our Facebook page, what better place to share your thoughts? Join me there and let’s continue the conversation: Happy Wives Club Facebook

Fawn Weaver