Recession Proof – Step 4

Hopefully, you’ve been following our blog series for the past few days and you know we’re doing something we’ve never done. We’re talking about finances. I came to the realization last week that many in this Club are likely in the same boat as most of this world, experiencing one of the worst recessions of our lifetime.

I also know that finances is one of the areas I love talking about most and helping others get out of debt, so I thought, “Why not help my fellow happy wives?” With that goal in mind, I began a series of blog posts dedicated to helping you and your family become Recession Proof. No matter where you find yourself in this mess of an economy, rest assured your family can rise above it. This post is part three so I encourage you to go back and review the first two installments if you weren’t with us last week.

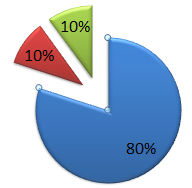

You may have heard over the years about the 80/10/10 rule. I grew up understanding this principle and was forced to abide by it in my parent’s home. I say forced because what kids wants to give up 20% of their allowance each week? But in our house, it was not an option.

You may have heard over the years about the 80/10/10 rule. I grew up understanding this principle and was forced to abide by it in my parent’s home. I say forced because what kids wants to give up 20% of their allowance each week? But in our house, it was not an option.

If you’ve not heard of the 80/10/10 rule, it’s quite basic: 10% of all your income is set aside for a tithe (giving), 10% is set aside as savings and the other 80% is spent as you deem best. This is a formula you will hear most financial experts talk about and it is one Keith and I highly recommend and have come to follow ourselves.

But I concluded long before I met Keith that the 80/10/10 rule is a goal but the 10/90 rule is a requirement. Let me explain what I mean. Before I continue writing, now is a good time to invite anyone who did not view the first blog on this topic to please click here. There is a disclosure regarding this subject that’s important for you to read prior to joining us in this series entitled Recession Proof.

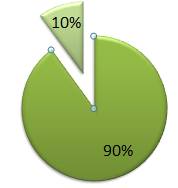

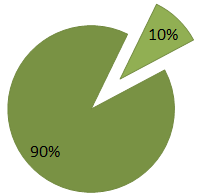

Okay, everyone’s read the disclosure? Great. Allow me to explain the 10/90 rule. It’s quite simple and THE MOST IMPORTANT point I will make throughout this blog series. There are 10 steps to creating a recession-proof marriage, household and overall life. Step 4, in my opinion, is the absolute most important and if it is the only step you follow, I believe you will see a change in your life. Now, you may not become recession-proof, but your financial situation will begin to improve.

And here it is…drumroll please… The first 10-percent of your income does not belong to you. Forget about it. It doesn’t exist. It comes in and it immediately goes out. It never has time to settle into your bank account, no interest ever grows on it. You are solely a funnel. It goes in and it goes out. Period.

And here it is…drumroll please… The first 10-percent of your income does not belong to you. Forget about it. It doesn’t exist. It comes in and it immediately goes out. It never has time to settle into your bank account, no interest ever grows on it. You are solely a funnel. It goes in and it goes out. Period.

Did you know in the Bible there is only one place God tell us to test Him? Yep, only one place. And it’s Malachi 3:10, “’Test me in this,’ says the LORD Almighty, ‘and see if I will not throw open the floodgates of heaven and pour out so much blessing that you will not have room enough for it.’” Now, I know tons of people who love quoting this scripture but few who actually know what it is referencing.

Let’s test your knowledge. At the beginning of the scripture when God says, “Test me in this…”, what is “this” that He is referencing? Well, if you know the answer to that question, you know about the 10/90 rule. God is referring to tithing. Giving the first ten-percent of your income to the church.

There has been a dispute about tithing as long as there has been arguments about varying theology. Most people find it difficult to “give up” what they believe they own. In addition, if you speak to 8  different people: a theologian, rabbi, priest, evangelical pastor, televangelist, online minister, director of a faith-based charity and director of a non-faith based charity, you will get 8 different answers to this one question, “Is giving a tithe required?” And if even half could agree on it being required, none would agree on where the tithe should go.

different people: a theologian, rabbi, priest, evangelical pastor, televangelist, online minister, director of a faith-based charity and director of a non-faith based charity, you will get 8 different answers to this one question, “Is giving a tithe required?” And if even half could agree on it being required, none would agree on where the tithe should go.

But if you speak with 8 wealthy individuals and ask the same question, you will likely get the same answer: YES! They may disagree on whether the tithe needs to be given to the church or to a charity but they will agree on the tithe as being the minimum amount of income that should be given away.

Don’t believe me? Go to the top of the Forbes Rich List and work your way down. Better yet, look in the top personal finance books of all time. All of them. Even in Rich Dad Poor Dad, one of the best-selling (if not the best-selling) personal finance books of all time, author Robert Kiyosaki says regarding tithing, “If I could leave one single idea with you, it is that idea.” He wrote an entire book on what his “Rich dad” taught him that “Poor dads” tend not to teach their children and tithing was one of the most important lessons.

Kiyosaki goes on to repeat something his rich dad would always say, “Poor people are more greedy than rich people.” He also noted that his educated “Poor” dad gave a lot of his time and knowledge, but almost never gave away money.

almost never gave away money.

I am no theologian and have no desire to be (although I’ve studied the Bible extensively over the past 15 years) so I can only share my personal story with you, as well as others I’ve come across throughout my lifetime.

Without exception, every person I’ve ever spoken with who has had ongoing financial challenges has not followed the 10/90 rule. And without exception, every person who has decided to follow this rule consistently – especially, when in the midst of a major financial crisis — has seen their financial situation improve dramatically.

I have no explanation for this phenomenon other than God loves a cheerful giver. Giving is a matter of the heart. So not only is this rule the most important to follow, doing so cheerfully is almost just as important.

When Keith and I fell in love, we did so over the phone. We were introduced by someone else and hadn’t even met each other in person before we knew we’d likely spend the rest of our lives together. After finally meeting for our first date, by the time we concluded the evening, we both knew this was the last relationship we would ever have. We’d found our soulmate and it would be for a lifetime.

Now, let me share a secret with you. If when Keith and I’d had our first discussion about tithing, if he’d told me he wasn’t comfortable with giving ten-percent of our collective income to the church, we likely would not be married today. It makes me incredibly sad to even think about my life without  Keith and I’m so happy I don’t have to beyond this moment and only for the purpose of writing this blog post.

Keith and I’m so happy I don’t have to beyond this moment and only for the purpose of writing this blog post.

Here is the reason I would not have married Keith if we were not on one accord regarding the necessity of giving away at least a tenth of our income: I knew our household would not be fully blessed. Regardless of whether or not ministers can agree on tithing, I know the principle of tithing works and God, for whatever reason, continues to bless the hands and lives of those who tithe cheerfully.

Let me share my personal story with you. I mentioned my parents taught me the 80/10/10 rule when I was young. I’d get allowance and 10% would go in an envelope for church and 10% would go in an envelope for savings. As I got older, I continued with giving the first ten-percent of my income to the church and saving another ten-percent.

But somewhere around my early 20’s I began “borrowing” from my tithes envelope. Now, Keith says he thinks “borrowing” was better than not giving at all because at least I was acknowledging the tithe belonged to God. I think he’s just being nice because he loves his wife. Here’s what I know for sure. As long as I was not taking the first 10% of my income and giving it to the church, I was always in debt. No matter how much I made, I never had enough to make it to the next paycheck. Hand-to-mouth was definitely my realization.

No matter how much I made, I never had enough to make it to the next paycheck. Hand-to-mouth was definitely my realization.

One day, I looked at my tithe envelope where I’d written all the money I’d “borrowed” (I literally had a makeshift entry journal on the front of the envelope so I didn’t forget how much I took) and knew there was no way I could pay it back. I’d gotten in too deep. So I prayed to God and asked Him to forgive me. I then made a commitment I’ve never broken and is also the reason I would not have married Keith if he wasn’t committed to tithing, “Lord, if you get me out of this financial mess I will never borrow from your tithes again. Never.”

And let me tell you something. I’ve never broken that pledge and I’ve never had a financial difficulty since. It took a little bit of time (maybe six months or so) for me to get out of the financial mess I’d made but I tithed from the moment I said that prayer and from that moment forward, the tithe has literally “passed” through my hands. It does not stop even for a moment. As soon as the money comes in, a check goes out. Period.

But I don’t just believe in the principal of tithing because the wealthy do it and it is something I believe kept me from living hand-to-mouth for most of my adult life. I believe it because I’ve also seen it work in the life of EVERY person I know who has committed to doing it.

Over the years, I’ve had the pleasure of helping people get their personal finances in order. I never made a business of it, I simply enjoyed doing it. But there has always been one condition in my agreeing to help. They must tithe. I don’t want to waste my time giving advice or spending resources trying to help someone organize their debt and spending habits to begin creating a “recession-proof” life if they’re not willing to tithe.

Over the years, I’ve had the pleasure of helping people get their personal finances in order. I never made a business of it, I simply enjoyed doing it. But there has always been one condition in my agreeing to help. They must tithe. I don’t want to waste my time giving advice or spending resources trying to help someone organize their debt and spending habits to begin creating a “recession-proof” life if they’re not willing to tithe.

About ten years ago, a family member came to me and she and her husband were continuously having financial challenges. It was not a rare occurrence for their lights to be turned off or to come home and they didn’t have gas or water. It was taking a toll on their relationship and their overall life.

I made them a deal. I would act as their business manager. We would set up a household bank account where each of their paychecks would be deposited. I would then give each of them an allowance to cover all of their needs and a reasonable amount of their wants each month (more on allowances and “needs vs. wants” tomorrow). I would pay all their bills from their household account and supply them with a monthly statement so they’d know exactly how much they had and how much they were saving.

exactly how much they had and how much they were saving.

I agreed to do all of this under one condition and one condition only: they would have to begin tithing…immediately. They could not argue with me about it. They could never question it. Ten-percent of their income, whether they understood why or not, would go to the church the moment their paychecks were deposited.

What happened over the next year I’m certain will not be a surprise to you. Within a few months, my wonderful family members saw their crazy financial situation begin to stabilize. They had several freelance jobs offered to them almost instantaneously that allowed even more money to begin coming in to pay off their debt.

Within a year, they were nearly debt-free and by the next year they were putting a down payment on a four-bedroom home in a beautiful California neighborhood. And it probably also won’t surprise you that the home was offered to them at nearly half of its actual value. They started off with equity in their home – and a lot of it.

Stories like this are not rare. It has happened with every single person (and couple) I know who have begun tithing and committed to becoming better stewards of the other 90% of their income (more on  a this tomorrow). When a couple comes to me that has continuously had financial challenges, I always have two questions: 1) Are you tithing? and 2) What are you doing with the other 90%?

a this tomorrow). When a couple comes to me that has continuously had financial challenges, I always have two questions: 1) Are you tithing? and 2) What are you doing with the other 90%?

But even though I always have two questions, I only get a chance to ask one. I never get to the second question because the first answer for those I’ve met struggling financially has always been “No.” No, they’re not tithing. And thus, I always know where to advise them to begin.

In the one instance where a couple responded that they’d been tithing. Keith and I were both stumped. We’d never run into an instance in which a couple having continuous financial challenges were also tithers. We remained baffled for a few months until we learned the whole story. The couple was tithing “when they could.” Sometimes they would and sometimes they wouldn’t.

Here is where it is truly a matter of the heart. God knows if you’re giving 10% of your income, cheerfully, and consistently. I know some find it difficult to give to a church. And for good reason. Many have abused the tithe. Some of the biggest culprits of wasting financial resources are churches and ministers.

I’m convinced the reason few congregants adhere to pastors and preachers on the importance of tithing is they’ve subconsciously disqualified them to deliver that message. Many have subconsciously concluded that since pastors and preachers have something personal to gain from receiving the tithe, they are delivering a biased message.

So maybe you’ll consider listening to someone who has nothing to gain by telling you it’s not only wise to make tithing a staple principle in your household, I truly believe it is one of the fastest ways to begin rising from the ashes of a recession.

Listen, I’ve heard all the arguments against tithing to the church. I get it. And in most instances, I agree. BUT — and it’s a very big but – a church wasting resources is not a good enough reason to not give your tithe. It is not wise to allow the poor decisions of a few churches, ministers, and televangelists to dictate your personal financial destiny.

Just as I said in an earlier post, it doesn’t matter if the entire country or world is in a recession, your household isn’t required to participate. The same is the case with the tithe. There are many churches out there doing great things with the tithe and doing what churches are supposed to do, which is help the poor, orphans, widows and children.

Just as I said in an earlier post, it doesn’t matter if the entire country or world is in a recession, your household isn’t required to participate. The same is the case with the tithe. There are many churches out there doing great things with the tithe and doing what churches are supposed to do, which is help the poor, orphans, widows and children.

When you look at third world countries, it’s the church that continues to spread the message of helping those in poverty and motivating millions of people annually to do something about it. There are many churches out there and if yours isn’t one of them…find a new church. But don’t withhold the tithe for your own financial sake.

There are many who say you can give 10% to a charity and it doesn’t have to go to the church. Keith and I give to charities and prayerfully we will always have more than enough to do so. But, personally, this giving is above and beyond our tithe and we consider it an offering. In your household, you must decide what is right for you. I am not able to give advice on tithing to a charity because I’ve never done it and I’ve never tested it out with other couples.

In the past, whenever someone has come to me with financial challenges, the first thing I tell them to do is begin giving. It’s something about giving to the church that God just seems to honor. And I’ve never had one couple (or person) continue to struggle after they’ve applied the 10/90 rule consistently.

We’ve talked about the first 10% and tomorrow we’ll talk about what to do with the other 90%. It’s all about stewardship. God gives abundantly to those He can trust to be good stewards. And He takes away from those He cannot.

Are you one God has entrusted with his wealth? If you’re not sure, check your bank account. It won’t tell a lie. And if you don’t need to check your account to know you can do better, you’re already halfway there. Determine to begin giving ten percent today because those who learn to live on less than 90% will always have more than those who live on 100. It’s always been that way and it’ll always be that way.

Until Monday…make it a great weekend!

Comments: With more than 15,000 Happy Wives Club members already actively engaged on our Facebook page, what better place to share your thoughts? Join me there and let’s continue the conversation: Happy Wives Club Facebook

Fawn Weaver

Latest posts by Fawn Weaver (see all)

- 5 Special Gifts for National Husband’s Day - January 21, 2015

- 6 Easy Ways to Exceed Your Spouse’s Expectations - January 20, 2015

- Two Great Questions You Should Ask Your Husband…Today - January 19, 2015